How to work with Funding Rate?

In the world of cryptocurrency derivatives, especially in perpetual futures trading, the Funding Rate mechanism plays a key role. This tool helps balance futures and spot market prices, preventing them from diverging too much. Let’s look at what Funding Rate is, how it works, why negative funding occurs, and how to use this knowledge in trading.

What is Funding Rate?

Funding Rate is a periodic payment (usually every 8 hours) between holders of long and short positions. Its main purpose is to keep the futures price close to the spot price of the asset.

- If the futures are trading above the spot price (contango), longs pay shorts (positive Funding Rate).

- If the futures are trading below the spot (backwardation), shorts pay longs (negative Funding Rate).

The greater the imbalance between long/short demand, the higher the absolute value of the Funding Rate.

How is the Funding Rate calculated and applied?

Formula

Funding Rate = Premium Index + (Interest Rate Differential).

Premium Index reflects the difference between futures and spot prices.

Interest Rate Differential — the difference in interest rates (usually fixed by the exchange).

Example

If Premium Index = 0.1%, and Interest Rate = 0.01%, then Funding Rate = 0.11%.Longs pay 0.11% of their position to shorts every 8 hours.

Frequency

Most exchanges (Binance, Bybit, OKX) pay Funding Rate three times a day — at 04:00, 12:00, and 20:00 UTC.Negative Funding Rate: Why Does It Occur and How to Use It?

Negative funding occurs when shorts dominate the market and the futures price falls below the spot price. This often happens in conditions of:

- Panic selling (for example, during market crashes).

- Oversold asset, when traders open short positions en masse.

Strategies for a negative Funding Rate:

- Holding long positions: Receiving payments from shorts.

- Arbitrage: Buying an asset on spot and simultaneously shorting a future to lock in the price difference.

- Predicting a reversal: A negative Funding Rate may signal a possible price rebound.

Factors Affecting Funding Rate Changes

- Market Liquidity: Low liquidity increases volatility and imbalances.

- Market Events: Hard forks, listings, macroeconomic news.

- Whale Behavior: Manipulation through mass position opening.

- Bets on Other Platforms: Traders can transfer positions between exchanges to find profitable funding.

Practical principles of working with Funding Rate

Data monitoring

- In the quotes section, you can track the Funding Rate for each asset.

Risk management

- Avoid holding positions with a high Funding Rate during volatility.

- Consider commissions: frequent payments can «eat up» profits.

Hedging strategies

- Close positions before funding is accrued if its size is critical.

- Use stop losses to minimize losses.

Following the trend

- A positive Funding Rate often accompanies a bullish trend, a negative one — a bearish one.

Bitcoin, December 2020

Funding Rate reached 0.1% (longs paid shorts). A week later, BTC decreased by 30% in 1 day — the market was overheated.

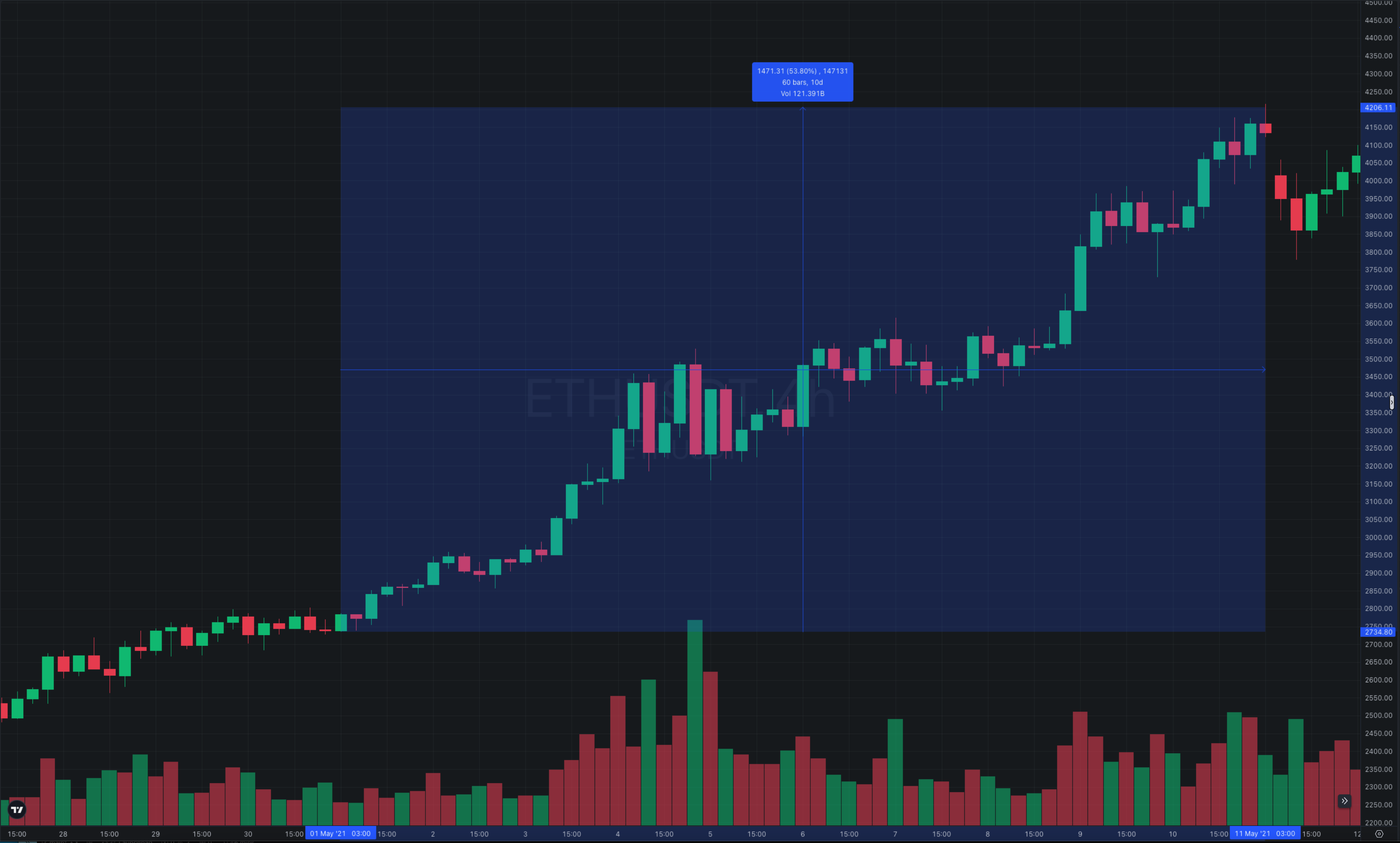

Ethereum, May 2021

Negative Funding Rate (-0.05%) preceded ETH’s 60% growth in 11 days — shorts became the «fuel» for growth.

Funding Rate is not just a technical indicator, but an important tool for analyzing market sentiment. Negative funding creates opportunities for arbitrage and cash flow profits, but requires caution. Successful traders combine Funding Rate data with technical and fundamental analysis. Remember: funding is a «cost of time,» and its impact on equity can be significant over the long term.

Other Knowledge Base Articles

Basic theory

The main parameters of the asset

What is Open Interest?

What is Price?

What is Trade Volume?

What is Liquidity?

About Our Screeners

Open Interest Screener

Pump and Dump Screener

Volume Screener

Custom Screener

Funding Screener

Soon