How to catch pullbacks after falls

In the highly volatile cryptocurrency market, traders are looking for tools that allow them to quickly respond to changes. One such tool is a **price screener**. In this article, we will analyze a strategy that helps use such signals to find profitable entry points after falls.

Receiving a signal from the screener

The screener is configured to track significant price drops (for example, 5-10% over a short period). After receiving the message, it is necessary to analyze the asset using three key parameters:- Trading volume

- Open interest (for futures)

- General price trend

Goal: determine whether the fall is a temporary correction or the beginning of a downtrend.

Trading Volume Analysis

Volume shows the activity of market participants:- High volume during a decline is a sign of a strong seller. This may indicate a continuation of the downward movement.

- Low volume is a signal of weak selling pressure. A price rebound is possible.

Open Interest (OI) Assessment

Open Interest (relevant for futures markets) reflects the number of open positions:- OI growth during a decline is an increase in short positions. If the price starts to rise, a «short squeeze» (massive closing of shorts) is possible, which will push the price up.

- OI decline — traders are taking profits on shorts, which reduces the potential for a sharp pullback.

Trend Definition

Analysis of the general direction of the asset price movement:- Correction in an uptrend is a favorable opportunity to buy.

- Fall in a downtrend is a risk of further decline.

Additional tools

Moving averages (e.g. EMA 50/200),

Trend lines,

Support/resistance levels.

Search for pullback signals

After confirming the conditions (low volume, rising OI, uptrend), look for signs of a reversal:- Candlestick patterns: hammer, engulfing, pin bar

- RSI divergence: the price updates the minimum, but the indicator does not

- Breakthrough of local resistance

Opening a trade

- Entry point: defined after the appearance of rollback signals (for example, the candle closes above the previous maximum)

- Stop loss: set below the local minimum or key support level

- Take profit: defined at the level of previous maximums or using the risk/reward ratio of 1:3

Risk management

- Do not risk more than 2-5% of capital in one trade. Or better 0.5 — 1% (especially if you practice averaging)

- Combine the strategy with other indicators (MACD, Volume Profile)

- Consider macroeconomic events that can affect the market. Follow the news, updates in US monetary policy and speeches of important people

Example of using the strategy

Situation

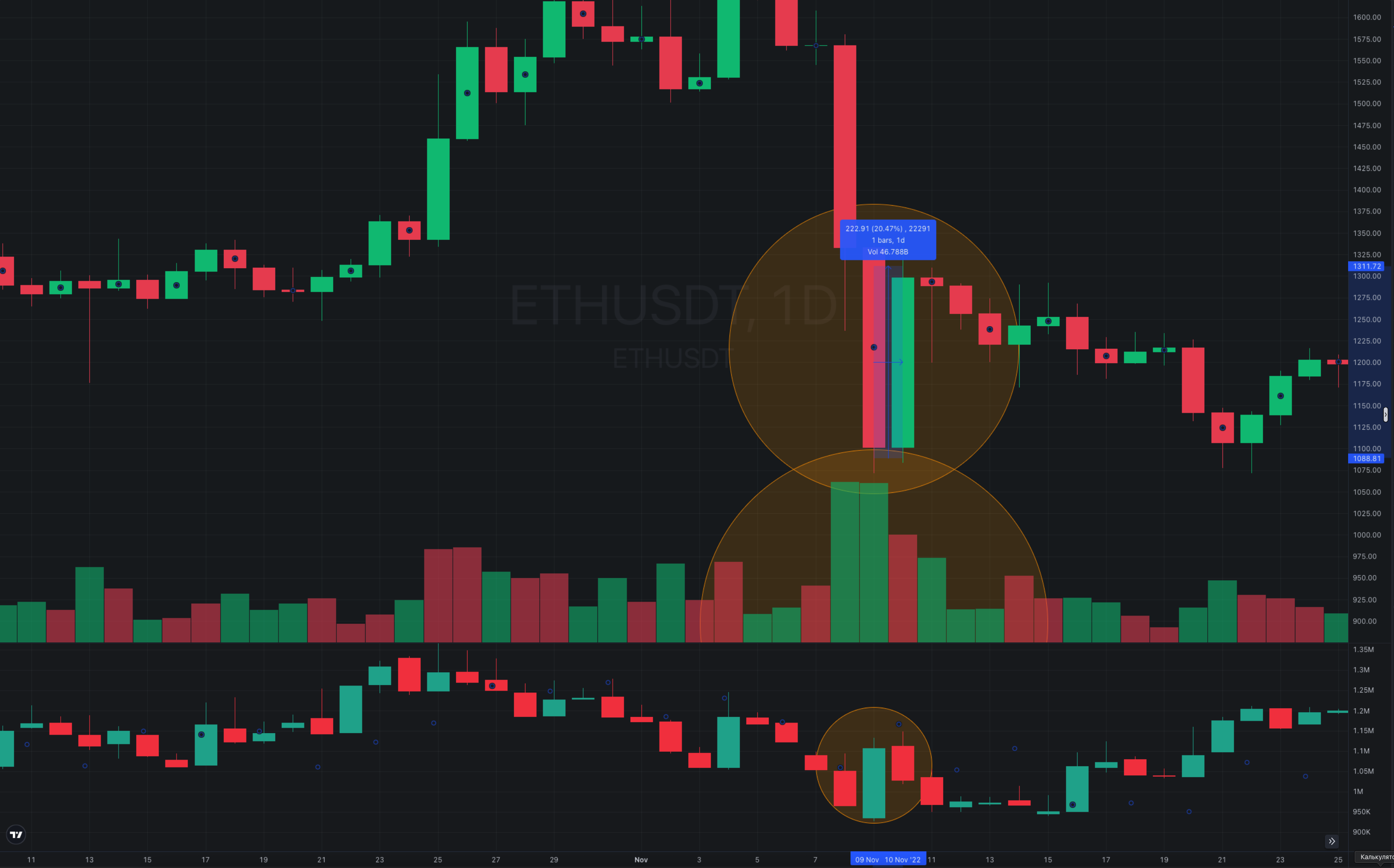

Ethereum falls by 18% in a dayETH/USDT, Binance exchange, daily candles

Analysis

- Volume is above average

- Futures OI is up 15%

- General trend before the fall is upward

A strategy based on a price screener allows you to systematically approach trading after corrections. The key conditions for success are a strict selection of assets by volume, open interest and trend, as well as discipline in risk management. Remember: no tactic guarantees 100% results, so always test it on historical data before using it or on a demo account.

Other Knowledge Base Articles

Basic theory

The main parameters of the asset

What is Open Interest?

What is Price?

What is Trade Volume?

What is Liquidity?

What is Funding Rate?

About Our Screeners

Open Interest Screener

Pump and Dump Screener

Volume Screener

Custom Screener

Funding Screener

Soon