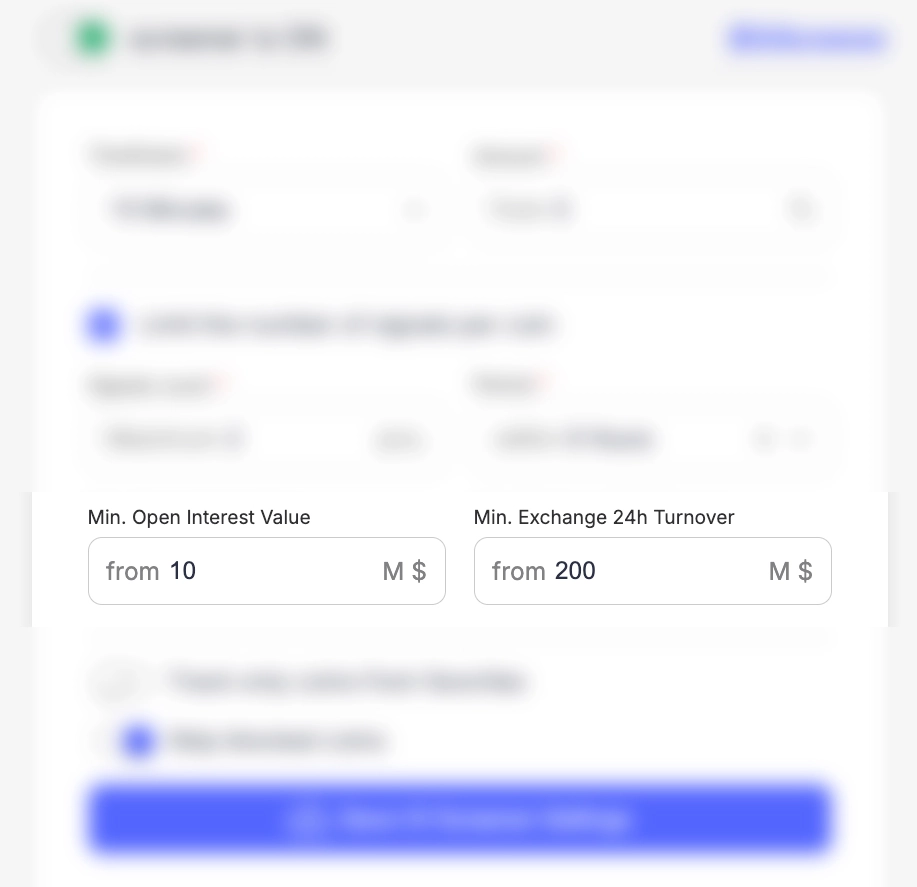

@OpenInterestScreener

Setting up the Open Interest Screener

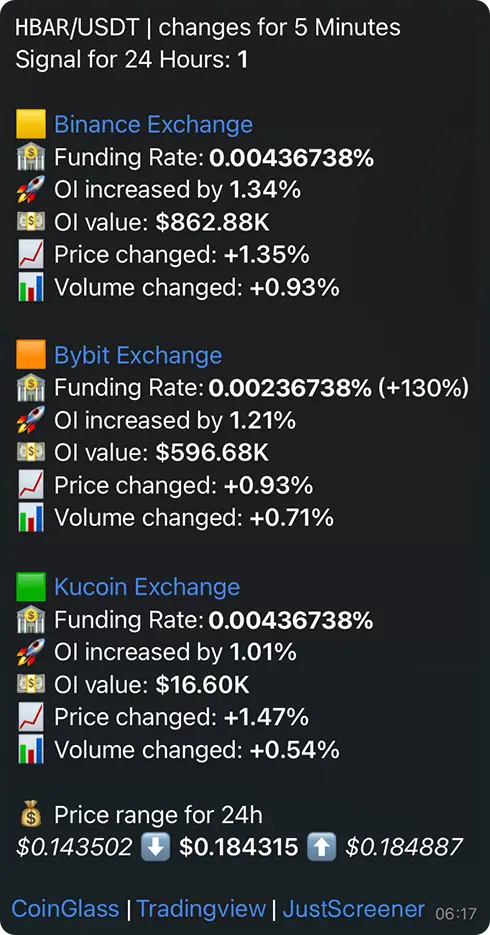

The main setting of the open interest screener is, surprise-surprise, the open interest indicator. It is configured by two parameters: the percentage of open interest change and the interval during which this change (increase or decrease) should occur.

As for the percentage of increase or decrease, you can set any indicator from 1%. But take into account the high volatility of cryptocurrency markets. Here, fluctuations (even in the price indicator) even by several percent in a short period of time are a normal situation. Therefore, we recommend specifying a percentage change of at least 10% or limiting the trading volume for the coin for 24 hours (but more on that later). Depending on your strategy, you can set both an increase in open interest (by specifying a positive value) and a decrease.

The second mandatory parameter is the interval of change in the open interest indicator, which can be set from one minute to one hour. Here it is worth sticking to the golden mean: the optimal interval is 15-20 minutes, since we remember the high volatility of cryptocurrency. And if you specify too short an interval (for example, 1 minute), too many messages will come.

Number of Signals

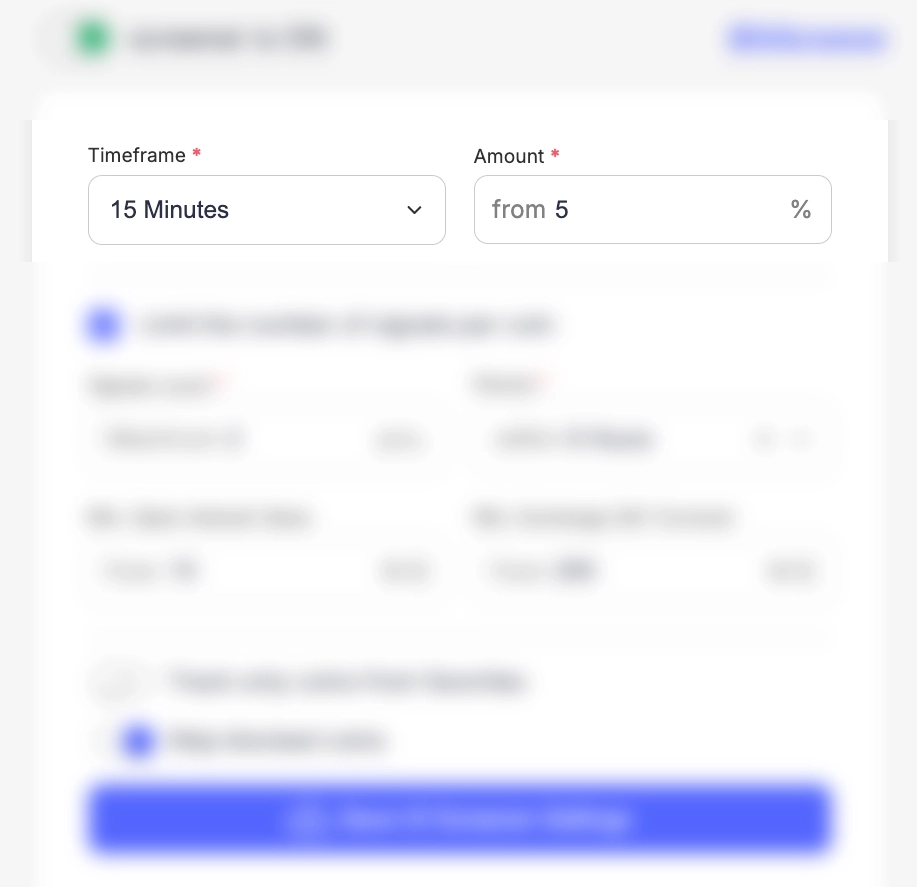

Now let’s look at additional settings that can help you avoid a large number of signals and wasted time on weak or too volatile assets. These settings are not mandatory, but we strongly recommend using them.

Since the main strategy for working with the open interest screener is to find deals with a growing OI indicator in order to enter a promising asset before anyone else, it is important to work out the first signals. This is exactly what the «Limit the number of signals» setting is for. When it is activated, you have two parameters: the number of signals and the period that will be taken into account when calculating. Everything is simple here: the first 1-3 signals are the most valuable for finding promising assets.

As for the period, everything depends on the intensity of your trading. If you are actively trading, you can set a fairly small interval: 3-12 hours is the most optimal value. But if you do not want to reduce the «noise» and receive fewer messages, but with a greater potential for processing, set a value from 12 to 24 hours. The signal counter is calculated for each coin separately (excluding the exchange), so we recommend always using this setting. This setting also allows you to avoid blocking by Telegram for too many messages.

OI and 24h Turnover

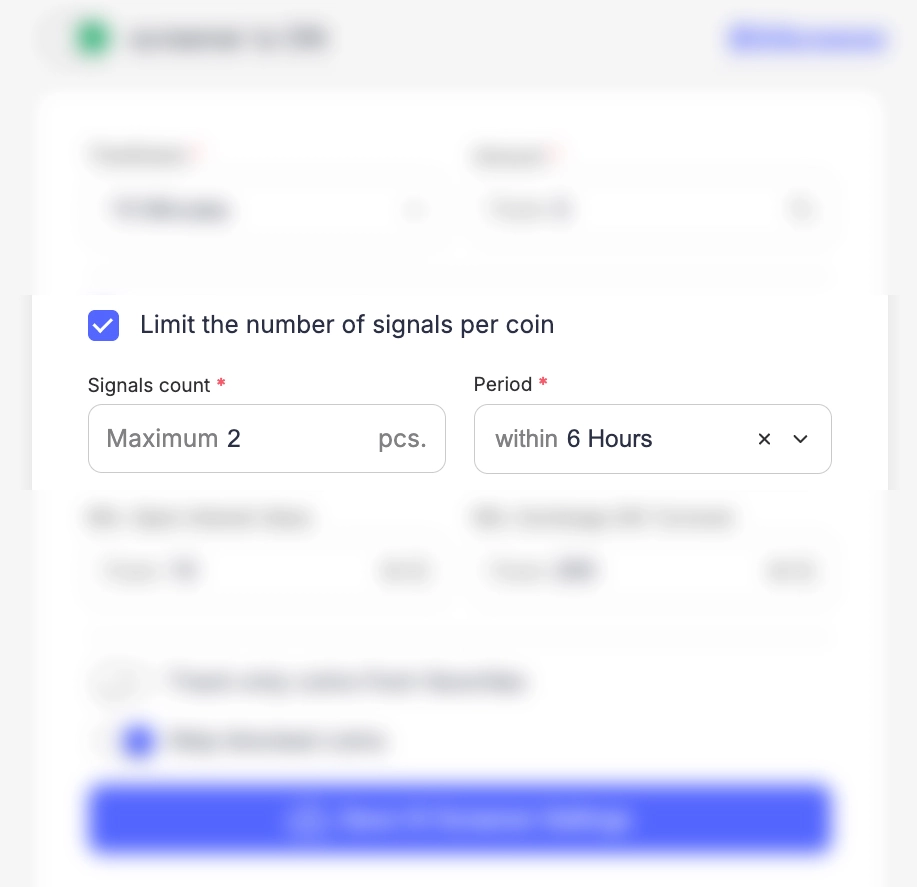

The next optional but recommended setting is to limit coins by the open interest indicator and the trading volume on the exchange for 24 hours.

The open interest indicator limit (calculated by the open interest amount for 24 hours) allows you to receive messages only for coins with many open orders. This allows you to remove assets with weak trader activity (and therefore little money). But it is important to understand that the open interest indicator for the same coin can vary significantly on different exchanges.

The trading volume indicator limit filters out coins with few closed deals well (remember that the volume indicator indicates already closed deals for the asset). This way, you can remove risky assets that have just been listed on the exchange (such coins are often subject to strong manipulation, since they have not yet managed to gain sufficient volume) or coins for which traders make few transactions.

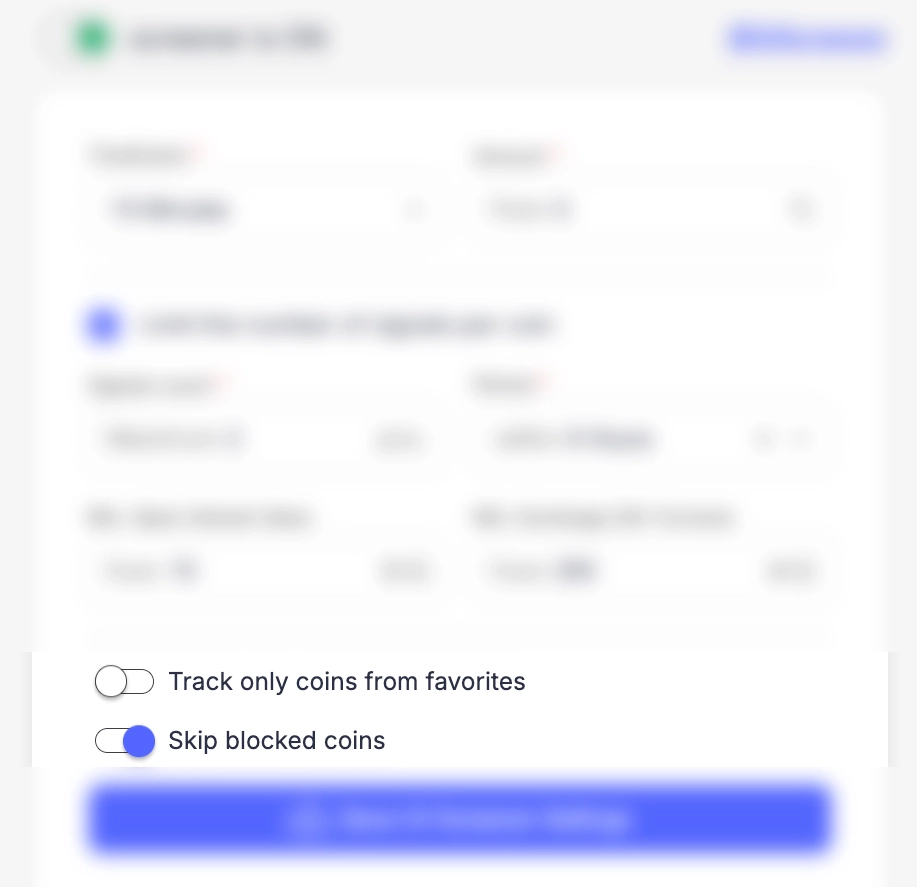

Limit by Favorites List and Skip Blocked Coins

Tracking only favorite coins - this setting allows you to receive messages only for coins that you have added to your favorites. For example, if you are in positions on several coins and you want to react quickly to small changes that would trigger a flood of messages if tracking was done for all coins.

Skipping blocked coins - if you want to remove some coins from tracking (for example, tokens with low liquidity), you can add them to the blocked list. Such coins will be excluded from tracking and messages about them will be ignored.

Open Interest Change

Receive notifications about changes in open interest for an asset to find coins with growth potential. The 24/7 screener analyzes all futures pairs on exchanges and immediately sends a message to the Telegram bot about changes in your settings.

@OpenInterestScreener

Universal Settings

Are there any universal settings that guarantee profitable trading? Unfortunately, there are none. There are many factors in the movement of the cryptocurrency market and high volatility. And if one day the market can vigorously grow upward, showing good volumes, then on another there may be a lull and most assets move sideways. Well, and then comes the day when suddenly some strong news appears, which instantly reverses the trend and even strong assets, such as Bitcoin, show a sharp decline.

Therefore, it is important to always analyze the asset on different timeframes and make an informed decision. The screener is not a «money button». It can tell you what to pay attention to, but the decision is always yours.

Experiment with different settings and look for the optimal strategy that suits your psychology, trading intensity and goals. Have a profitable trading and remember the risks!

Other Knowledge Base Articles

Basic theory

The main parameters of the asset

What is Open Interest?

What is Price?

What is Trade Volume?

What is Liquidity?

What is Funding Rate?

About Our Screeners

Open Interest Screener

Pump and Dump Screener

Volume Screener

Custom Screener

Funding Screener

Soon